4 AEP Opportunities That Medicare Advantage Plans Can’t Afford to Ignore

This year, member experience takes center stage. Are you ready?

By: Bill Phillips, Chief Content Officer

Which came first: The satisfied member or the highly rated Medicare plan?

Answer: Yes.

New research from GHG Advisors reveals how the two work hand in hand. Satisfied members grade plans favorably—driving up Star ratings—and plans with higher Star ratings have happier members and far lower switch rates.

In fact, says GHG, plans rated between 2.5 and 3.5 Stars have nearly double the switch rate of a 4-Star plan, 20% versus 11%. That number continues to fall at 4.5 Stars (9%) and 5 Stars (7%).

According to McKinsey, moving a 3.5 rating to a 4.5 would result in an additional $40 per-member-per-month rebate from the Centers for Medicare & Medicaid Services (CMS), along with the competitive advantage of enrolling beneficiaries all year, outside of open enrollment. Both are huge, but the retention benefits are equally meaningful—if not more so—to the bottom line.

CMS is laser-focused on patient experience, of course. The Consumer Assessment of Healthcare Providers and Systems (CAHPS) survey, which accounted for 18% of a plan’s Star rating last year, will drive 34% of it by 2024. This presents a huge opportunity for Medicare plans to create unique content-rich experiences that differentiate them from competitors, make members happier, and drive Stars improvement.

Takeaway: Star ratings pay a plan back in more ways than one—and there are more tools available to move them than ever.

GHG’s data also reveals that year one in the plan-member marriage is the most critical in terms of retention and quality ratings. Nearly a quarter (24%) of Medicare members switch within the first year. Get them past their paper anniversary and the rate falls to 12%. And only 7% of members who stick with a plan for 5 years end up switching.

Takeaway: Love the one you’re with—before it’s too late.

Learn About the 2021 Medicare Engagement Toolkit

Meanwhile, a Deft Research survey of nearly 3,500 Medicare shoppers conducted last December revealed these choice data nuggets:

Medicare Advantage is on fire, now accounting for 42.5% all those enrolled in any type of Medicare plan. (That number should reach 50% by 2025, according to The Chartis Group.)

- Medicare Advantage switch rates continue to fall—12% of MA members switched during last year’s annual enrollment period (AEP), down from 23% in 2015. The reason: With payors offering many more plan options—with more innovative plan benefits—members are less likely to be lured away by competitive offerings.

- Medicare Supplement switch rates continue to rise—9% last year, up from 6% in 2018. Med Supp members are increasingly attracted to MA plans.

- A quarter of Med Supp and Original Medicare members say that bundled medical and drug coverage would be appealing, perhaps not realizing that’s what MA plans offer.

Takeaway: Well, hello MA. You be sexy.

MA’s relentless march, plus the increasing emphasis on member experience as part of the Stars formula, might have you wondering: How can you make the most of the opportunity during this year’s AEP?

Linkwell Health’s specialty is helping payors large and small create a world-class member experience—particularly in the Medicare Advantage space—so we’ve got a few ideas.

Here the four opportunities we see for 2021 and beyond to grow market share, improve member experience, and take the Stars changes to the bank.

Opportunity #1: Create an editorial calendar that pairs member and business needs

Most payors have content. Some have a lot of it. But in Linkwell’s experience, few are creating and distributing it strategically to drive business goals.

Think about your content and ponder these five questions:

- Does it give your brand a voice and point-of-view that helps you stand out from your competitors?

- Does it deepen trust and credibility with your existing members and prospects?

- Does it surprise, delight, inspire, and empower?

- Does it follow the golden rule: Serve before you sell?

- Does it help you solve your key business goals?

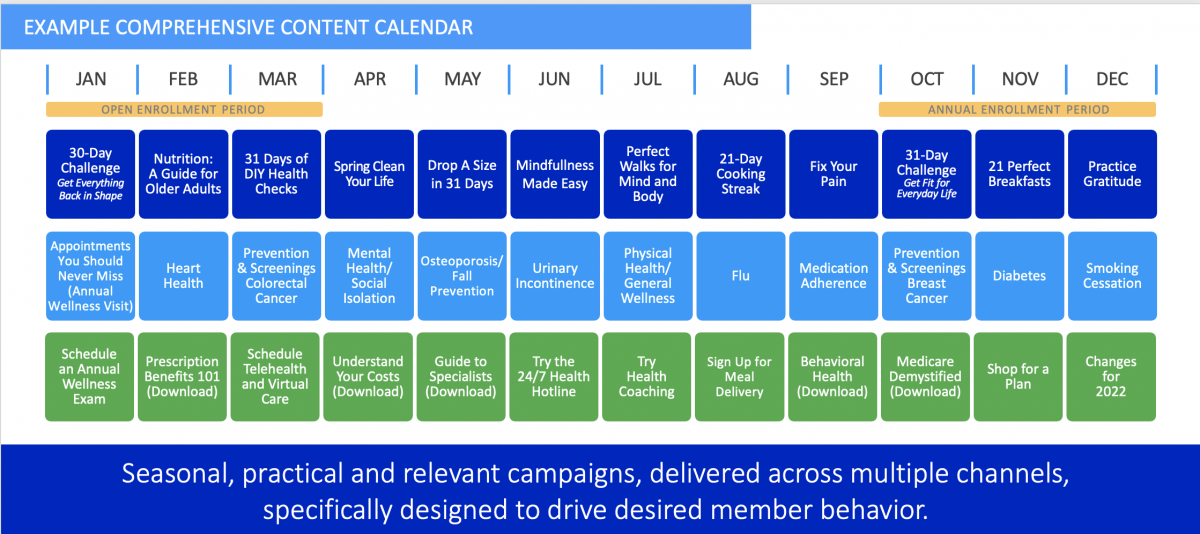

If you didn’t answer each question with a resounding “hell yeah,” you have work to do. At Linkwell, we recommend that payors create an annual editorial calendar that ties content campaigns to key performance indicators. Here’s a sample:

On the top row are programs, stories, and initiatives that drive high member engagement. In other words, it’s stuff that readers will like, comment on, and share.

The middle row are campaigns and content that educate members and drive actions to support quality metrics. It’s the critical stuff that members need to know to protect their health—medicine they need, delivered in a way that’s kind of delicious.

On the bottom row are ways members can put their plan benefits into action. This is the stuff you want members to do—via embedded calls-to-action in the content of the first two rows. The actions will help them improve their health and improve your Star ratings at the same time.

Let me be clear: If the content you produce leads members to a dead end—there’s no CTA to click that drives a business metric—it’s not working hard enough for you.

This multilayered approach ensures you’re creating highly engaging content that members love, and at the same time improves their experience (Stars scores) and drives CTA clicks (cha-ching).

Opportunity #2: Be the carrot, not the stick

As member experience determines a bigger chunk of a Medicare Advantage plan’s Star ratings, payors will need to increasingly adopt a member-first mindset. That means this shift in thinking:

Old: What can you do for us, member?

New: Here’s what we can do for you, member.

Consider, as an example, access to care, as “getting needed care” and “getting appointments and care quickly” are both heavily weighted components in the CAHPS survey.

Your large network of primary and specialty providers is great. But unless you’re actually breaking down the barriers to accessing the care they provide, your network is like the proverbial tree sitting on the forest floor that no one saw or heard.

Linkwell Health is increasingly called upon to help solve this puzzle by creating a front-of-the-member-portal destination for health and wellness content that a) lures members to a plan’s digital destination and b) empowers members to better manage their health and, if necessary, contact a healthcare provider for guidance.

This content can be distributed in a number of ways: email, SMS, social, even print. Once members arrive on the plan site, calls to action within the stories pull members to the portal to, for example, find a provider.

Alternatively, the CTAs can encourage one-touch dialing so the member can immediately schedule a telehealth appointment, annual wellness visit, or even a house call.

Opportunity #3: Meet members where they gather

You’re a small-town entrepreneur with a compelling value prop: You make the world’s most delicious lemonade. You have two choices for distribution:

Option #1: Mail some letters and send some emails, encouraging people to swing by the house and ring the doorbell when they’re thirsty.

Option #2: Drive to the corner in town where more than half of the town’s residents hang out every day, and set up a lemonade stand or sell your magic juice from the car.

If #2 seems more appealing to you, allow us to introduce you to the most popular corner in the world for older adults: Facebook. In a Healthinsurance.com survey of 1,000 seniors, 52% of them said they use the social media platform every day, and another 19% are on Facebook at least once a week.

Linkwell Health helps many payors find and communicate with their target audiences on social media, both organically and via paid. And though Facebook is the platform everyone loves to hate, it remains the most cost-effective way to reach your members and prospects, serve them helpful content, and drive them to your site to learn about your plan options.

In other words, Facebook is the rooftop under which your target audience is gathering. Start shouting.

Opportunity #4: Embrace OEP as an extension of AEP

Let’s talk about buyer’s remorse. It’s real. In a study in Ecological Economics, 82% of adults reported that they’ve felt it after making a big purchase at some point in their lives (the other 18% must be monks or billionaires).

Humans are programmed to a) make impulsive decisions that make us happy and b) avoid risks that could make us sad. Those opposing forces are constantly battling it out in our brains, which explains why the car dealer always wants you to take the test drive.

Once the car is in the garage, however, the second-guessing starts: Did I really need this? Can I really afford this? How will I fit four kids in two seats?

The top three reasons for buyer’s remorse, according to a 2015 study of more than 2,000 adults: “didn’t meet expectations,” “didn’t end up using,” and “costs too much.”

The same is true of any important purchase, including a health plan. And the open enrollment period (OEP) from January 1 to March 31 gives members an opportunity to undo their decision without consequences. What’s a health plan to do?

Once again, content is part of the solution. To wit:

“Didn’t meet expectations”: Set clear expectations at the time of purchase and consistently during the months that follow—plan benefits, how they work, any wrinkles that a member may encounter and how to smooth them.

“Didn’t end up using”: Encourage members to use the plan, starting in January with, for example, an annual wellness visit. For one major health plan, Linkwell Health created a 10-day member-orientation program for new and returning members, distributing it via email, social, and SMS during the OEP period.

“Costs too much”: This complaint isn’t about cost; it’s about value. It’s critical to deliver tons of useful stuff to members at a regular cadence: easy-to-understand plan education, actionable health and wellness information, and impeccable customer service across all platforms. Remind them what they’re getting for their money, and their cost concerns will fade away.

All of the above is doubly important for new members. Remember: Members are most likely to switch during the first year.

Linkwell Health has a bold belief: People should love their healthcare. It’s on page two of our general presentation. A few years ago, we were laughed out of a couple of rooms for saying it. These days, payors lean in instead. Why? Because it’s possible—and it’s happening.

Last year, we did a content campaign for a large plan around demystifying Medicare. One of the comments on Facebook stood out. A woman in her 70s wrote: “Thank you for this information. You make paying insurance a pleasure.”

It’s a start.

Learn About the 2021 Medicare Engagement Toolkit

This story was reviewed for accuracy by Leslie V. Norwalk, Esq., the Acting Administrator of the Centers for Medicare & Medicaid Services under the Bush Administration and a member of the Linkwell Health Board of Directors.